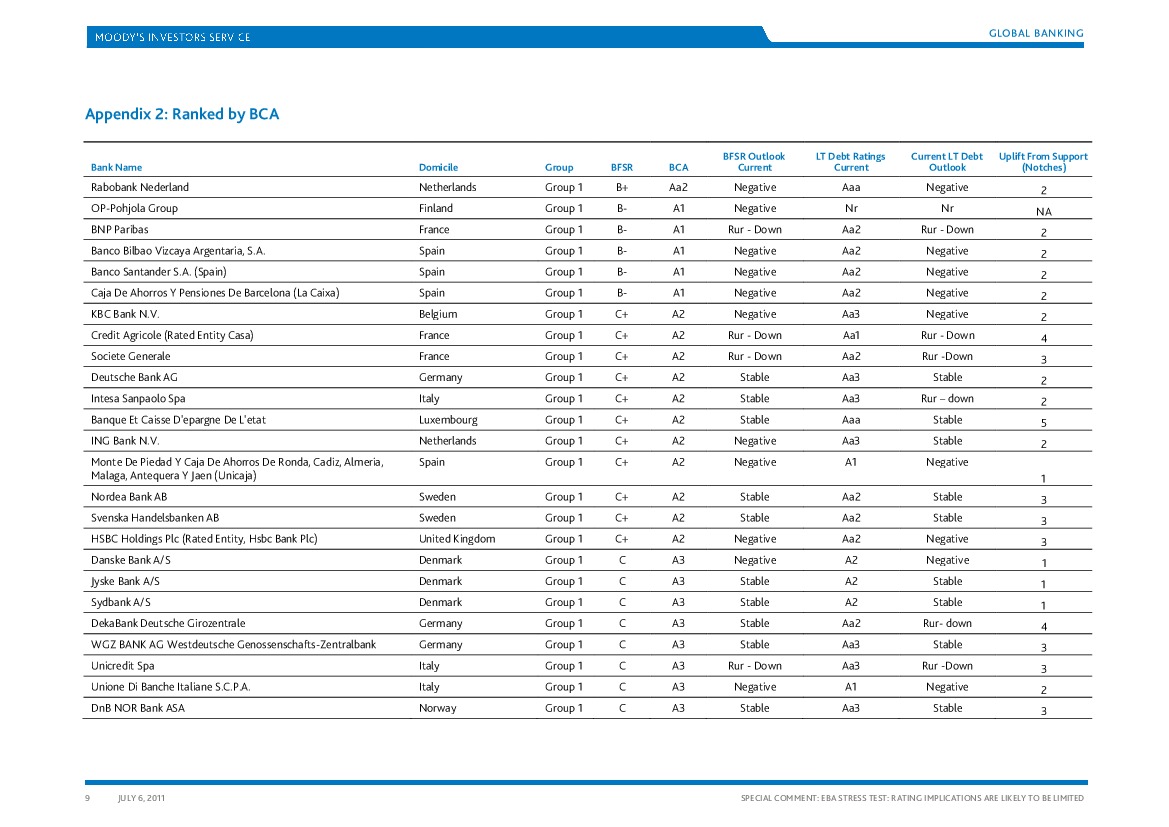

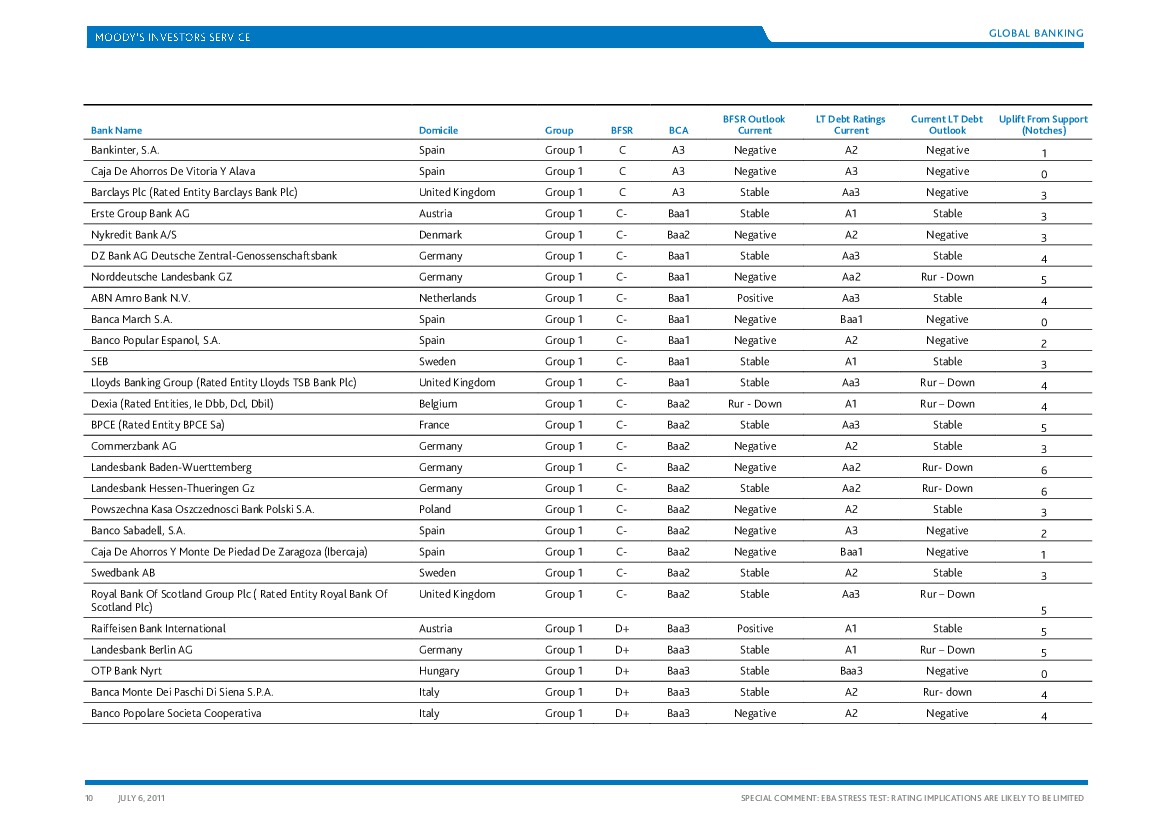

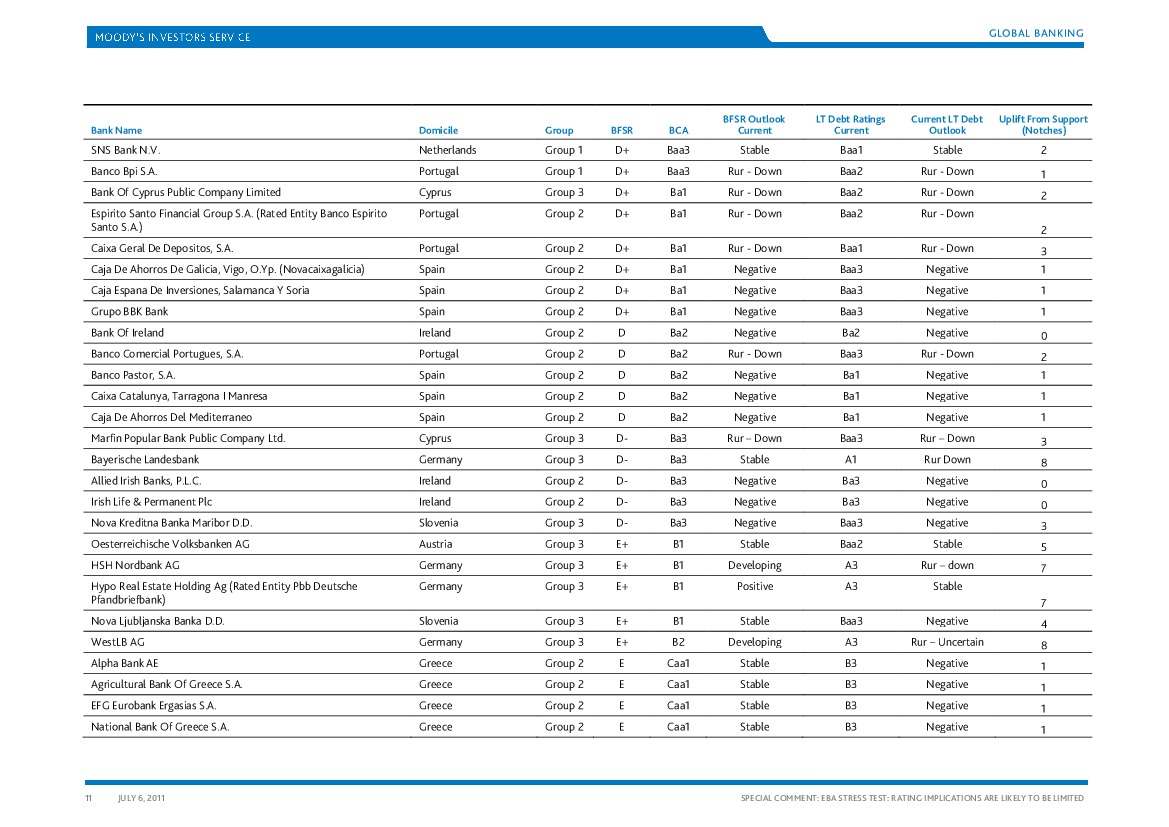

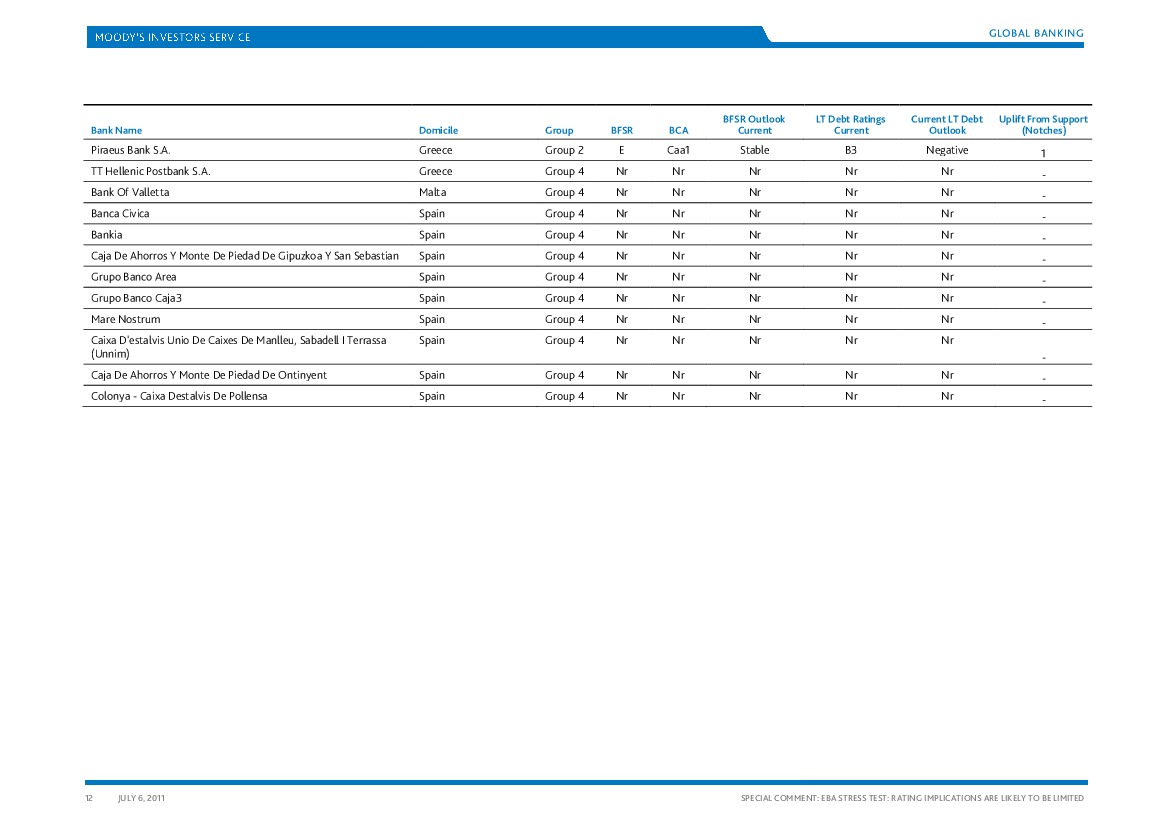

Esta es la lista publicada por Moody’s hace dos días.

Banks from group 1 (see Appendix 2 and 3) are best able to absorb shocks. Any such banks which fail the test would very likely be downgraded in short order.

Banks from Group 2 (see Appendix 2 and 3) can be broken down into 2 sub-groups:

* Sub group 1: banks from Greece (5), Ireland (3), Portugal (3) which have already received a great deal of external support. This assistance has been extended either in the form of capital injections – from shareholders or from governments – or in the form of funding obtained through government support mechanisms (e.g. guaranteed debt) or from the ECB.

* Sub group 2 : Banks from Spain (6 banks). We recently published a Special Comment (Moody’s Estimates of Spanish Banks’ Capital Positions – Rationale, Results and Sensitivity Analysis – June 14, 2011) in which we estimated that, given existing capital shortfalls and loss mitigants (i.e.charge-offs, reserves, stressed one-year earnings and excess capital) and assuming stricter capital requirements published by the Bank of Spain in February 2011, the overall capital shortfall for Spanish banks amounts to approximately €45 billion in the base-case and to approximately €119 billion in a stressed scenario.

* Both sub-groups are inherently weak and are candidates for additional support going forward.

Banks from Group 3 (see Appendix 2 and 3) : banks from Austria (1), Cyprus (2 ) , Germany (4) ; Slovenia( 2). The four German banks (West LB, HRE, HSH, Bayrische Landesbank) are undergoing major restructuring with public assistance. In contrast the Cypriot banks (Bank Of Cyprus Public Company Limited, Marfin Popular Bank Public Company Ltd) have large exposures to Greece, which makes capital buffers vulnerable to a potential Greek sovereign default in particular if the loss given default were significant.

Banks from Group 4 : unrated banks (11) mostly from Spain (9).